EchoStar Stock Jumps 75% After AT&T’s $23 Billion Spectrum Deal – Investor Insights & Market Impact

EchoStar Stock Jumps 75% after AT&T’s $23 billion spectrum purchase. Explore stock analysis, market comparisons, investor strategies, analyst opinions, FAQs, and future predictions.

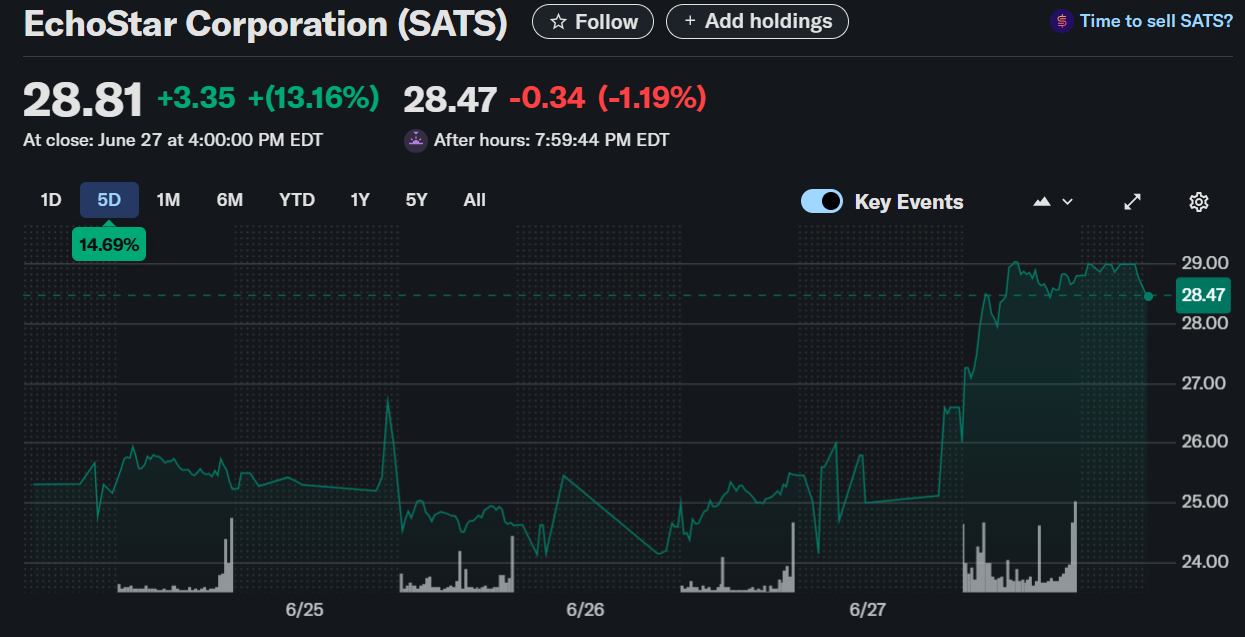

Wall Street rarely sees a 75% single-day surge in a mid-cap telecom stock. Yet that’s exactly what happened when AT&T (NYSE: T) announced it would buy wireless spectrum assets from EchoStar Corporation (NASDAQ: SATS) in a $23 billion mega-deal.

The news shook the U.S. telecom industry and immediately raised critical questions for investors:

- Has EchoStar unlocked hidden value, or is this a one-off spike?

- Can AT&T justify a $23 billion price tag in an already competitive 5G market?

- What opportunities and risks does this create for shareholders?

Let’s dive deep into the details with analyst perspectives, investor scenarios, comparisons with past telecom acquisitions, FAQs, and actionable takeaways.

1. The Deal That Shocked Wall Street

On announcement day, AT&T confirmed it would acquire nationwide 5G-ready spectrum licenses from EchoStar for $23 billion in cash.

For AT&T, this move is strategic: spectrum is essential to deliver faster 5G speeds, improve wireless coverage, and strengthen broadband services.

For EchoStar, this deal is transformational: the company, often overshadowed by bigger rivals, suddenly becomes cash-rich and financially flexible.

Quick Breakdown of the Deal

| Aspect | Details |

|---|---|

| Buyer | AT&T (NYSE: T) |

| Seller | EchoStar Corp (NASDAQ: SATS) |

| Transaction Size | $23 Billion |

| Type of Asset | Nationwide wireless spectrum licenses |

| EchoStar Stock Impact | +75% in one trading session |

| AT&T Stock Impact | +2.1% modest gain |

2. Why EchoStar’s Stock Exploded

The 75% stock surge wasn’t random—it reflected a complete re-rating of EchoStar’s market value.

Here are the key drivers:

- Cash Infusion at Scale: $23 billion gives EchoStar the flexibility to pay down debt, invest in satellite broadband, or pursue share buybacks.

- Hidden Value Unlocked: Investors long suspected EchoStar’s spectrum assets were undervalued. AT&T’s bid confirmed that theory.

- Strategic Optionality: With liquidity secured, EchoStar could pivot toward satellite internet, IoT, and rural connectivity—fast-growing markets.

3. AT&T’s Strategic Play

Why did AT&T commit such a massive sum?

- Catch Up in the 5G Race: Verizon and T-Mobile currently lead in coverage and speed. AT&T needed fresh spectrum to stay competitive.

- Rural & Suburban Broadband Push: More spectrum allows AT&T to serve previously underserved markets.

- Future-Proofing Network Capacity: With AI, autonomous vehicles, and IoT creating data surges, AT&T is preparing for the long game.

Simply put: AT&T is buying tomorrow’s dominance today.

4. Analyst Insights: Bullish, Bearish, and Neutral Views

Wall Street analysts had mixed reactions. Here’s a snapshot:

| Analyst | Stance | Key Takeaway |

|---|---|---|

| Goldman Sachs | Bullish | “EchoStar has monetized assets at peak value. Upside remains.” |

| Morgan Stanley | Neutral | “Good for AT&T strategically, but debt pressure continues.” |

| Barclays | Bullish | “Strengthens AT&T’s 5G edge and creates investor confidence.” |

| JP Morgan | Bearish | “EchoStar’s sudden 75% pop is unsustainable. Correction possible.” |

The divergence in opinion highlights uncertainty about whether EchoStar’s momentum can sustain in the medium term.

5. Investor Scenarios – What Could Happen Next?

Scenario A: The Bullish Case

- EchoStar reinvests into satellite broadband expansion.

- Cash is used to eliminate debt, improving credit ratings.

- Stock gains another 20-30% within 12 months.

Scenario B: The Neutral Case

- Stock consolidates after initial euphoria.

- Market waits for EchoStar’s capital allocation strategy.

- Shares trade sideways for the next year.

Scenario C: The Bearish Case

- Stock was overbought after the 75% spike.

- Short-term traders exit, leading to a 20% correction.

- EchoStar struggles to prove growth beyond spectrum sale.

6. Real-World Investor Example

Take the case of Maria, a retail investor from New York, who purchased 300 EchoStar shares at $18 each in early July 2024.

- Investment: $5,400

- Post-Deal Price: $31.50

- New Value: $9,450

- Profit in 1 Day: $4,050 (+75%)

Like many, Maria must now decide whether to lock in profits or stay invested for potential long-term growth.

7. Historical Comparisons – How Does This Stack Up?

To put this into perspective, let’s compare with other major telecom spectrum deals:

| Year | Deal | Value | Market Impact |

|---|---|---|---|

| 2011 | Verizon buys AWS spectrum | $3.6B | Strengthened LTE, stock up 15% |

| 2020 | T-Mobile merges with Sprint | $26B | Created No. 1 5G carrier, stock doubled in 3 yrs |

| 2025 | AT&T buys EchoStar spectrum | $23B | EchoStar stock jumped 75% instantly |

This shows how spectrum deals consistently reshape market dynamics—but outcomes vary.

8. Long-Term Impact: EchoStar vs AT&T

EchoStar Outlook

- Cash-Rich Balance Sheet: Enables innovation and growth.

- New Growth Avenues: Possible expansion into satellite internet (like Starlink competitors).

- Acquisition Target: Tech or telecom giants may find EchoStar attractive.

AT&T Outlook

- Stronger 5G Competitiveness: Can finally close the gap with Verizon/T-Mobile.

- Debt Challenges: Already heavily leveraged—$23B adds more pressure.

- Regulatory Scrutiny: The FCC may carefully examine this deal.

9. FAQs – Investor-Friendly

Q1: Why did EchoStar stock surge so much?

A: AT&T’s $23B spectrum purchase validated EchoStar’s undervalued assets, sparking investor enthusiasm.

Q2: Is EchoStar still a good buy?

A: Analysts are split—bulls see long-term upside, bears expect a near-term correction.

Q3: How will AT&T finance this deal?

A: Likely through a mix of cash, debt, and possibly asset-backed financing.

Q4: What risks exist for EchoStar investors?

A: Overvaluation after a sharp spike and uncertainty around reinvestment strategy.

Q5: Will regulators block this acquisition?

A: The deal will face FCC review, but approval chances are strong given competition levels.

10. Key Investor Takeaways

- EchoStar unlocked $23 billion in hidden value overnight.

- AT&T secures its 5G future but adds financial risk.

- Retail investors saw massive one-day profits, but sustainability is uncertain.

- Spectrum remains the most valuable commodity in telecom.

Final Thoughts – Buy, Hold, or Sell?

EchoStar’s 75% rally highlights how quickly Wall Street can reprice undervalued assets. But such spikes often lead to short-term volatility.

- Aggressive investors may continue holding, betting on EchoStar’s reinvestment strategy.

- Cautious investors might take profits and re-enter later.

- Conservative investors could look at AT&T for steady, long-term exposure to 5G growth.

One certainty: This deal has redefined the U.S. telecom landscape, positioning both companies for a decade of transformation.